Hollywood hearts went pitter-pat after the Warner Bros. Discover and Paramount Global CEOs ate lunch together, but would a merger accomplish anything?

Image created with Ideogram.AI and Adobe Photoshop.

After Warner Bros. Discovery (WBD) CEO David Zaslav and Paramount Global CEO Bob Bakish had a leisurely lunch together last week, the entertainment press exploded with “goodness, where’s my fainting couch?” speculation that the two companies would merge to create a bigger studio to compete with Disney and Netflix. (Cynthia Littleton’s Variety overview is a good place to start.)

The situation

Paramount’s stock is at nearly a five year low, and its market capitalization is just above $10B, so it’s a good time for another company to think about acquiring the studio that has Paramount, CBS, Showtime, Nickelodeon, MTV, Comedy Central, and much more.

The combination of the two studios would put Captain Kirk, Wonder Woman, Cartman, and Harry Potter into the same family (mirroring how Captain America and Princess Leia can pal around with Buzz Lightyear and Minnie Mouse over at Disney), give the combined companies lots of broadcast and cable channels, merge Max and Paramount+ into a streaming powerhouse, and throw in some NFL rights.

The Verge has a shrewd analysis of why this would be terrible for us, the audience, jacking up prices for streaming services, reducing competition, and therefore blandifying the shows we can watch, as well as squelching the diversity of the people who make and star in them.

But this is only true if you look at the possible merger through a backwards-facing lens rather than a future-looking one.

If the rumors are true, then Zaslav is setting himself up to be the new Beeper King, not the new apex predator among Hollywood moguls.

For those of you who don’t remember The Beeper King, this was Dennis Duffy, the character that Dean Winters (also known for “Mayhem” in the Allstate commercials) played over several seasons of 30 Rock. Dennis was Liz Lemon’s idiot boyfriend, and the fact that Liz kept breaking up with and then going back to Dennis demonstrated her towering insecurity.

The joke of Dennis styling himself The Beeper King was that this was after mobile phones had destroyed the market for beepers.*

Likewise, the market for—and viability of—independent entertainment companies is shrinking every year.

Looking at the numbers

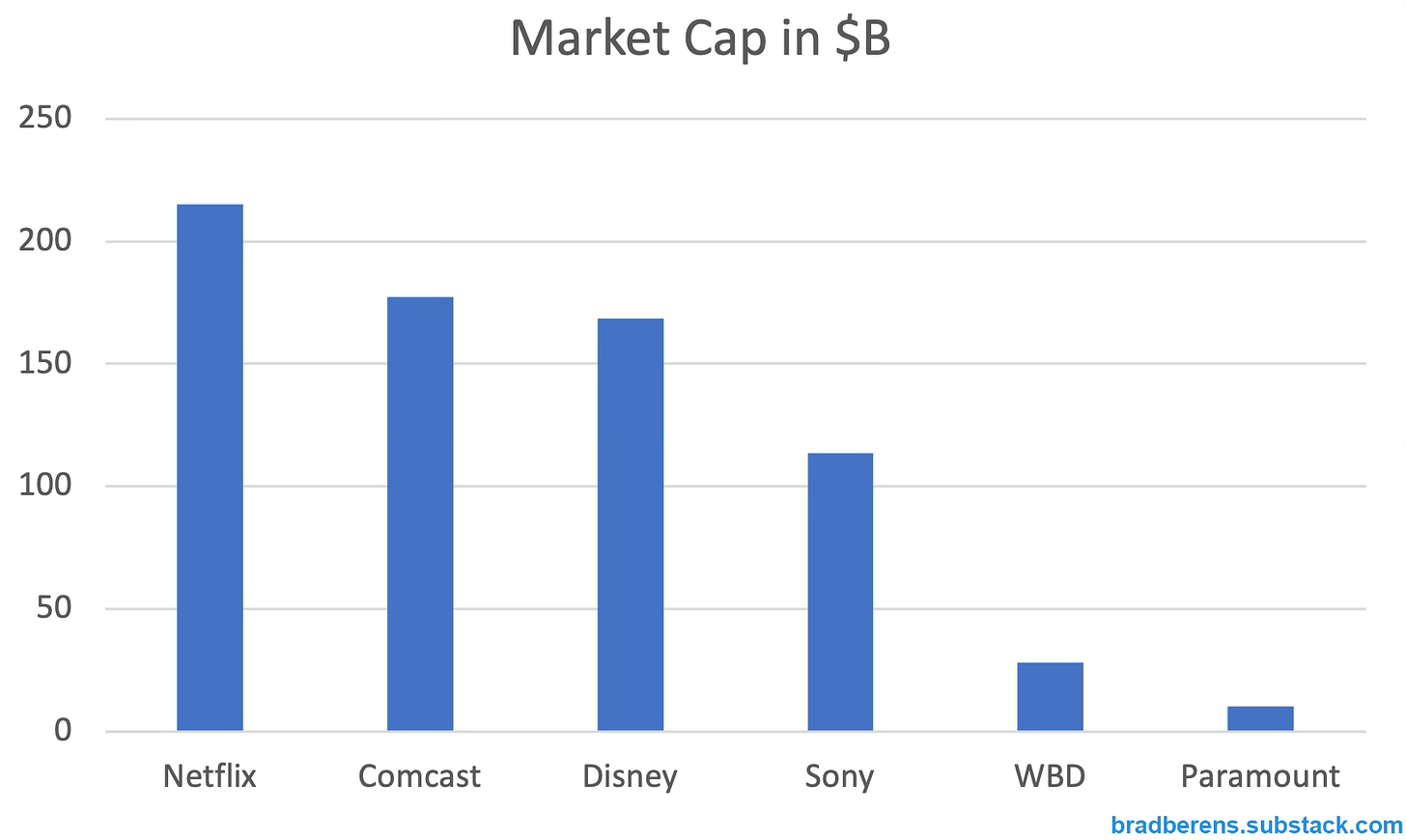

Here’s the backward-facing picture, looking at the market capitalization (as a handy but limited proxy for company health) of the big legacy entertainment companies:

WBD and Paramount together don’t even add up to a Sony, let alone the bigger traditional studios or Netflix.

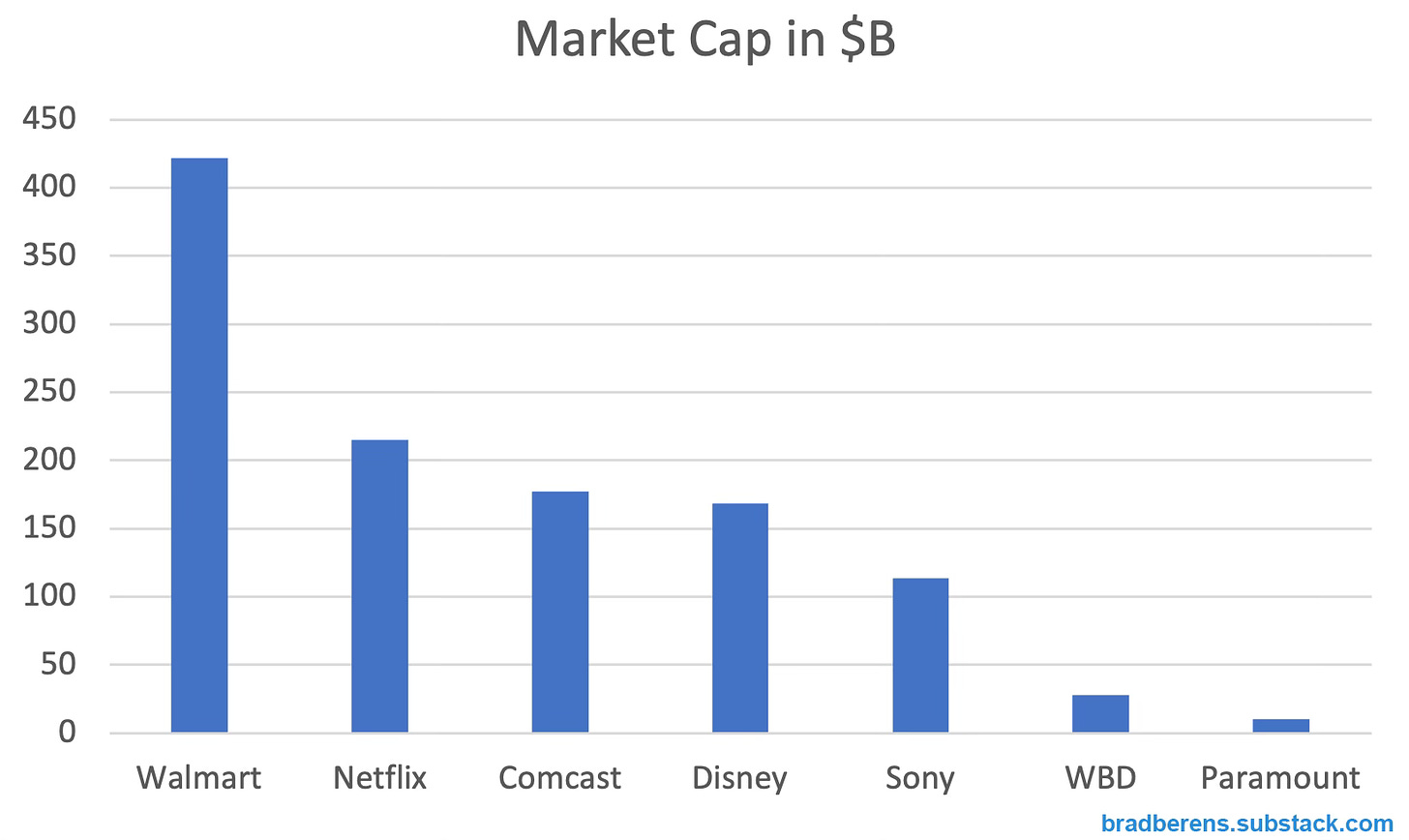

As regular readers of The Dispatch will remember, I’ve been arguing for some time that the most logical acquirer for Paramount is Walmart because it would help the new Walmart+ service go toe-to-toe with Amazon Prime.

Adding Walmart’s market cap to the previous chart looks like this:

Paramount is carrying $15B in debt, but even at a $25B price tag (the cost of all the stock plus the debt) it would be worthwhile because Walmart would gain a significant strategic advantage by adding its own streaming service to Walmart+. If the only way folks could get streaming access to the Paramount assets was by joining Walmart+, many would. (I’m a lifelong Trekkie, so this would be a no brainer for me.)

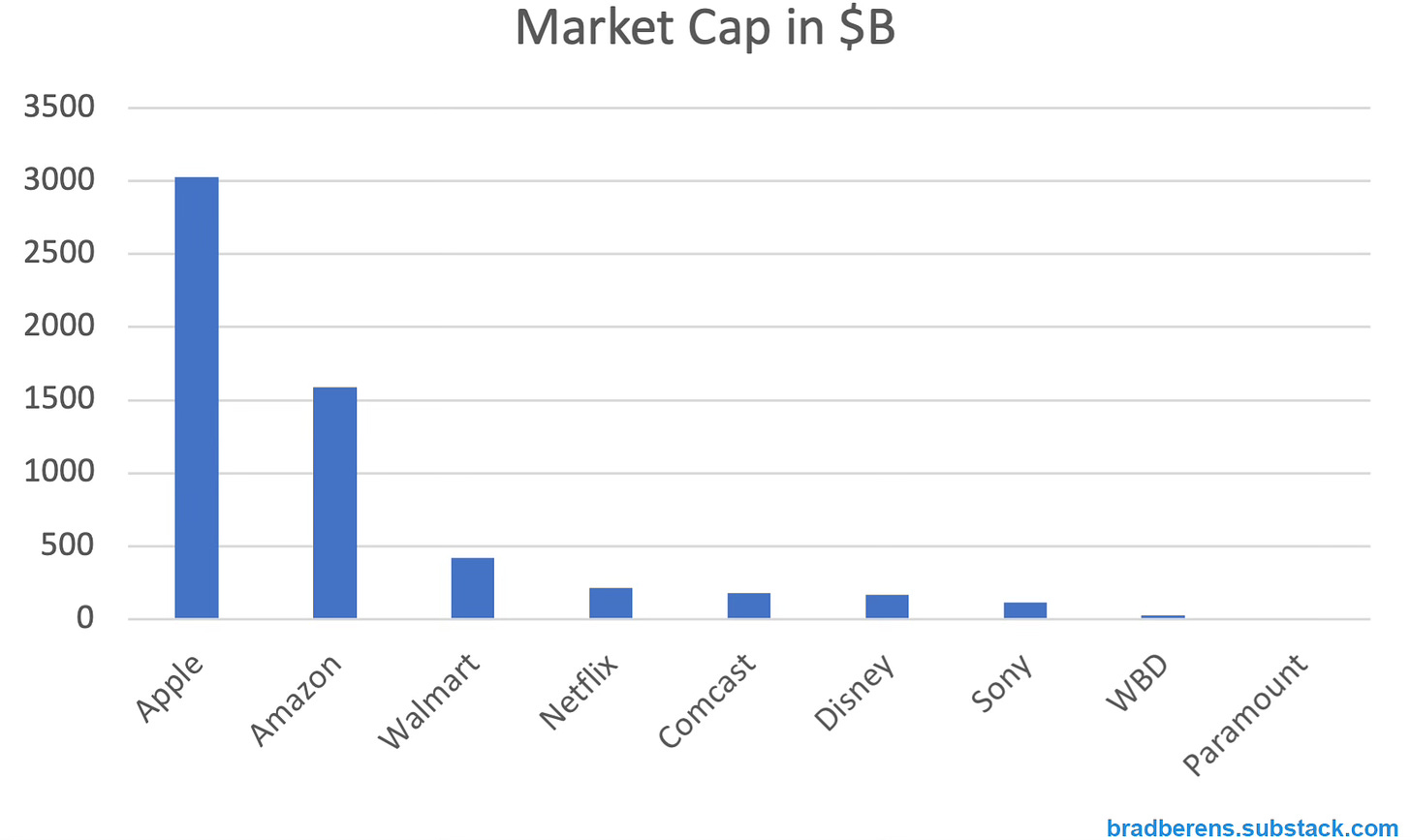

But even this is too simplistic. Let’s add Amazon and Apple to the mix:

Amazon is an unlikely buyer of Paramount since it already acquired MGM in 2021 and faced regulatory hurdles in doing so.

Apple, on the other hand, is 300 times the size of Paramount, has steadily built its small-but-impressive AppleTV+ service in house, and would increase the size of its content library by orders of magnitude by spending what amounts to petty cash. Apple has invested heavily in children’s programming, so Nickelodeon would extend its footprint there. Like Amazon, Apple has been moving aggressively into live sports, so the most valuable asset in a Paramount acquisition would probably be CBS Sports.

To complicate things even more, let’s add some other possible acquirers:

Both Alphabet (Google/YouTube) and Meta (Facebook) get most of their revenue from advertising, both lack premium content arms, and both could easily afford Paramount. Like Apple, YouTube has moved into live sports.

Microsoft could add Paramount’s assets and supercharge its Bing and Xbox advertising businesses without feeling the cost. Even Tesla, now facing more competition in the EV market, could buy Paramount and add access to its assets to the benefits of buying a car for less than a quarter of what CEO Elon Musk paid for Twitter. If Musk bought Paramount privately, he might try to use it to advertise Tesla heavily and block other car makers from doing so. (Although Musk famously hates advertising.)

Implications

In the near future, movies and television will be add-on features to other businesses rather than independent companies. The larger businesses will use entertainment to pull people into their overall ecosystems and keep them there. (I explored a version of this in my recent microfiction “Bubbles.”)

For media CEOs, this would be a benefit. These days, activist investors bedevil the CEOs of publicly traded entertainment companies. (Just search “Nelson Peltz and Disney” for a good example.) Although there are certainly activist investors with Apple, Amazon, et cetera, those activists would not focus on the profitability (or lack thereof) of a $10B entertainment sideline when talking about a business worth more than a trillion dollars. Just imagine the relief entertainment CEOs would feel if they could focus on making great product rather than cutting costs.

There are also downsides. CBS News is a vital part of the news ecosystem; the Ad Fontes Media Bias Chart rates it as highly reliable and minimally biased. If any company acquires Paramount, will that stay the same? (Jeff Bezos has stayed away from editorial interference since he personally bought The Washington Post, which is admirable, but will other billionaire CEOs act so honorably?) If the WBD/Paramount merger does indeed happen, then would the new company combine CNN and CBS News? Offload one of the two news organizations? Shut one down? Any of these would be yet another crippling blow for journalism in this country.

Merging WBD and Paramount is like neatly folding the laundry when your house is on fire: it mistakes mere activity for salvation.

Note: To get articles like this—and a whole lot more—directly in your inbox, please subscribe to my free weekly newsletter!

* 30 Rock premiered in October of 2006; the first iPhone came out in July of 2007, so the joke was about feature phones rather than smart phones. According to Pew, mobile phones had crossed the 50% penetration rate in the U.S. before 2004.

Leave a Reply