Imagine a venture-backed service company that loses around a billion dollars per quarter. This company sees slowing growth, which it has acknowledged in its IPO filing. The company depends on ill-paid human contractors to deliver its service– until an indeterminable time when robots might be able to take over for the ill-paid humans, whereupon the company can fire all the humans upon whose labor it built its business. Its core business is unprofitable, and it has expanded into a series of adjacent businesses that are also mostly unprofitable. On the week it approaches its IPO, some human workers strike in cities all over the world. Oh, and there’s nothing defensible about the company’s product offering. It even has a smaller rival that went public first; the rival’s stock lost nearly 1/3 of its value since going public. Nevertheless, the company is still going public, expecting to raise money at an eye-widening $80 billion valuation that will make its investors and executives obscene amounts of money.

You’re way ahead of me: this company is Uber.

The likelihood that ordinarily sensible investors will buy Uber stock represents the triumph of subsidized convenience over logic. This is the sort of thing that behavioral economists like Daniel Kahneman have been talking about for years: we humans are bad at math, bad at using statistics to analyze our daily experiences, bad at resisting the lure of lies that we have heard many times.

In other words, we decide with our hearts and justify with our heads.

The people who use Uber love Uber more and more with each passing year.

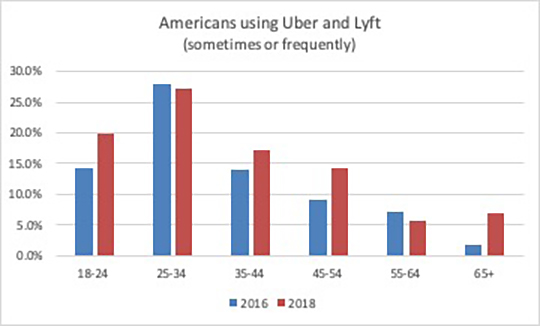

But how many of these people are there? Here is a relevant chart from the Center for the Digital Future’s recent U.S. survey:

The chart shows that most American age groups increased how much they use “get a ride” services like Uber between 2016 and 2018. The 25-34 group showed a .6 percentage point decline, but they are still the demo with the highest usage at 27.3%. The 55-64 group dropped by 1.4% percentage points. The rest of the demos were up: 18-24 went up by 5.8 percentage points; 35-44 up by 3.2 percentage points; 45-54 up by 5.2 percentage points, and 65+ up by 5.1 percentage points.

However, even for the demo that loves these services the most (25-34), 72.7% of them do notuse Uber or Lyft at all regularly. In that same study, 85% of all Americans use these services rarely or not at all.

As I and others have articulated before, Uber’s ridersenjoy a fantastic experience: seamless, intuitive, and subsidized point-to-point transportation. The data from the Center’s Future of Transportation project, which I direct, also shows that get-a-ride services have a transformative effect on American’s attitudes toward car ownership, making the prospect of not owning a private car twice as thinkable for Uber users. Of course it’s a fantastic experience: Uber is losing a billion dollars every three months making it a fantastic experience.

My experience as an Uber rider makes my heart sing. The business makes my head hurt.

As Uber launches onto the public market tomorrow, the question is will investors think with their heads or their hearts?

I know which organ Uber would prefer.

If you enjoy this newsletter:The Center is raising money to return to the field for another round of data in the Future of Transportation project. Please help us to continue this important research.

(5/9/19)