Regular readers know that I’ve been skeptically covering Elon Musk’s acquisition of Twitter (and other unhealthy decisions) for years. For both Musk admirers and detractors there has been a lot to follow lately:

- Tesla’s Q1 results were bad, with net income falling by 71%.

- The stock price is down from a high of $429.80 in January to $279.81 when the market closed on Friday, per Yahoo Finance.

- Musk responded by saying he would spend more time at Tesla rather than DOGE, which is convenient since he can only work 130 days per year as a non-confirmed “special employee” at the White House, which started 100 days ago.

- Tesla’s board quietly started looking for a new CEO (WSJ $).

- According to The Daily Beast, Musk had a “meltdown” over this, after which Tesla Chair Robyn Denholm posted a strong denial on Twitter/X:

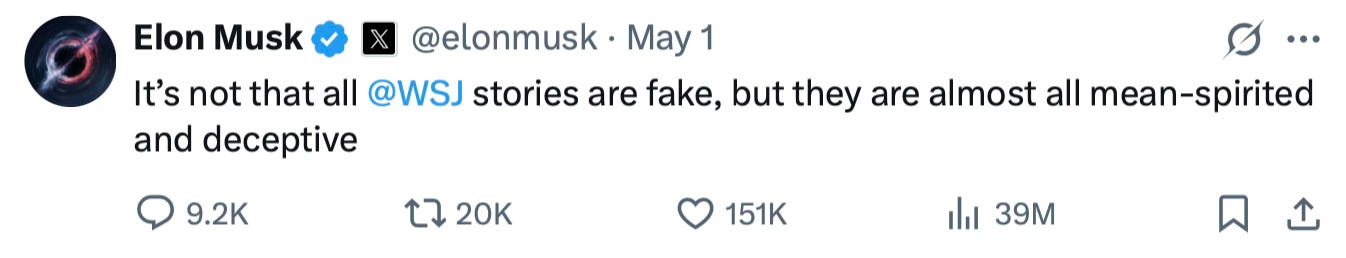

- However, it’s worth noting that Musk’s supposed meltdown consists merely of a few strongly worded tweets, for example:

and…

- In Inc. Magazine, op-ed writer Bill Murphy, Jr. pointed out that Tesla having no succession plan is a massive vulnerability for the company.

- Musk’s hope that robots will infuse new revenue into Tesla seems likely to face intense competition from China ($).

- Saturday Night Live, which happily invited Musk to guest host in May of 2021, has seized a comic moment, exercised its reserve activation clause, and brought Mike Myers back to play a hyperkinetic, massively ADD version of Musk over several episodes this season.

- “Even Republicans are Falling Out of Love with Tesla” per The Economist ($), which means that if my thesis is right—that Musk’s rightward swing was only ever an attempt to sell electric cars to conservatives and that he has no real values beyond money—then the attempt has failed. (Note, too, The Economist’s use of the pejorative “Democrat” as an adjective rather than “Democratic,” which betrays a political bias.

Analysis

If you look at Tesla’s stock over the last 5 months, it resembles the EKG of a man with a bum ticker on a triple espresso plus a short of cocaine.

However, that’s falling into a short-term thinking trap (common with public companies). If you look at Tesla’s stock over five years (rather than YTD) it’s still way up ($54.93 to $279.81).

It made no sense when the company hit an apogee market cap of $1.5 Trillion in December 2024. That was a hallucination that probably had more to do with Musk’s influence with the then-incoming Trump 2.0 Administration than anything to do with EVs.

With…

- More credible EV competition coming from domestic and foreign auto companies,

- An aging set of vehicle designs in general, and

- A Cybertruck model that looks like a refugee from the 1980s version of Battlestar Galactica and, more importantly, isn’t as functional as other EV Pickups, some of which are leaning into new ad campaigns ($),

Tesla’s earnings make sense outside its CEO’s political distractions, although Musk’s performance as the Artful DOGEr hasn’t helped.

In other words, this all adds up to a logical market correction. Tesla dominated the EV field for years. That dominance is waning. QED.

Leave a Reply